|

Datum: Heute, 15:12

| ||

... die Kläger argumentieren, dass der Treuhänder Bank of New York (BNY) keine immunisierte “intermediary bank" ist und deshalb durchaus eine gerichtliche "Specific Performance Order" ausführen muss:

Zitat:

Zitat:

|

Gesamtzahl der Seitenaufrufe

Montag, 29. Oktober 2012

diffiziles zur BoNY - ArgyTreuhänder

Sonntag, 28. Oktober 2012

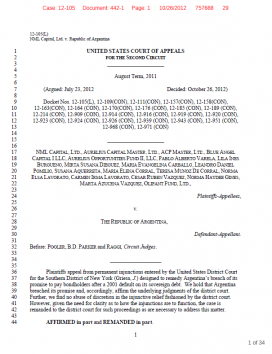

A pari passu upset? Joseph Cotterill

Argentina’s selective recitation of context-specific quotations from arguably biased commentators and institutions notwithstanding, the preferred construction of pari passu clauses in the sovereign debt context is far from “general, uniform and unvarying”…

That’s the U.S. Court of Appeals for the Second Circuit on Friday – in a sovereign debt ruling which might just set an interesting precedent or two.

Click for the full opinion:

The Court has ruled that the Argentine government did err after all in paying out on its restructured sovereign debt above holdouts’ bonds — and inter alia casting the interpretation of pari passu clauses, promises of “equal payment” that are fairly common across sovereign debt, into some turbulentis inordinatio. (The Court thus affirms an earlier District Court ruling by Judge Griesa, who ordered Argentina to pay bondholders equitably.) We suspect this ruling could also be controversial in what it says about the immunity of sovereign assets from holdouts…

The ruling firstly leaves Elliot Associates on something of a roll in its 10-year fight against Argentina, after the fund acquired a small slice of the Argentine navy earlier this month in a bid to secure assets for payment.

But this is also really not how a few observers expected the case to go, including Anna Gelpern and Felix (“ultimately the chances are that Argentina will prevail”). After all, as both pointed out, the law surrounding the “meaning” of pari passu is not easy to fathom, particularly over the issue of paying bondholders pro rata. Nor is picking over whether there are shades of “immunity” in the US Foreign Sovereign Immunities Act. Or at least you might have thought. Anna has also just now written a really good analysis of what this case might now mean, so we have only a few points to add.

Firstly it’s interesting that the court has appealed to pragmatism in rejecting Argentina’s argument that the terms of its restructured bonds never legallysubordinated the legacy debt. The court is essentially saying to Argentina: “You haveeffectively subordinated it by ‘repeatedly asserting’ that you will never pay out on it, and passing a law at home that forbids paying it so long as the restructured bonds are to be paid out. And in the first place, pari passu does not have that narrow meaning of legal subordination you think it does.”

As Anna writes, the court nevertheless didn’t go into massive detail about this law that Argentina passed (the Lock Law) despite its pretty clear effect. Instead the rejection of Argentina’s case is very broad – this “effectiveness” test. We wonder if, despite citing all the uncertainty over the meaning of pari passu, the court has nevertheless ended up nailing it down quite a bit — nailing it down in way that widens the scope for suing sovereigns for violating this clause de facto.

Over to immunity. The Court also gives short shrift to the idea that Griesa’s orders for relief will restrict Argentina’s immune assets in the United States in a way that contradicts the FSIA. Here’s the key par:

They do not attach, arrest, or execute upon any property. They direct Argentina to comply with its contractual obligations not to alter the rank of its payment obligations. They affect Argentina’s property only incidentally to the extent that the order prohibits Argentina from transferring money to some bondholders and not others. The Injunctions can be complied with without the court’s ever exercising dominion over sovereign property. For example, Argentina can pay all amounts owed to its exchange bondholders provided it does the same for its defaulted bondholders. Or it can decide to make partial payments to its exchange bondholders as long as it pays a proportionate amount to holders of the defaulted bonds. Neither of these options would violate the Injunctions. The Injunctions do not require Argentina to pay any bondholder any amount of money; nor do they limit the other uses to which Argentina may put its fiscal reserves. In other words, the Injunctions do not transfer any dominion or control over sovereign property to the court.

Long and involved, isn’t it?

Now, in terms of possible ripple effects, this is all New York contract law. So the leeway that the court seems to give to creditors in this case doesn’t have a direct bearing on any future eurozone debt restructuring, for example. The background to NML v Argentina also dates back to a funny time in sovereign restructuring. The court seems to suggest that by lacking collective action clauses in its debt, Argentina was uniquely vulnerable to holdouts in a way no government would be ever again. CACs are now regularly implanted in bonds, and are the sovereign restructuring tool of choice. Well,maybe — ask the holdouts in the Greek PSI. And also look at how the standard-setters for this kind of thing are really most concerned about getting the right aggregation clauses in CACs. (These clauses allow holders across a sovereign’s bonds to vote on a restructuring offer, versus taking votes by individual series of bonds.)

But the court itself shows some nervousness in its ruling about sovereign bond holdouts becoming able to sue third parties that assist a sovereign debtor, such as “banks acting as pure intermediaries in the process of sending money from Argentina” to holders of the restructured debt. And so the Court has asked for the original injunction on Argentina to be clarified…

Something which we imagine Bank of New York – trustee to the restructured holders – will be very interested in.

Related link:

Whose crisis was this anyway? – Letter to the FT

Whose crisis was this anyway? – Letter to the FT

This entry was posted by Joseph Cotterill on . Tagged withArgentina, Debt Restructuring, Pari Passu, Sovereign Debt.

Argentina's Stunning Pari Passu Loss

Argentina's Stunning Pari

Passu Loss

I have to give it to Reynolds Holding on this one: he called it, I was wrong, and today I paid him $5 in settlement of our bet. To the astonishment of almost everybody I know (except Ren), the Second

Circuit sided with Elliott Associates and ruled unanimously against Argentina today. It's a hugely important decision, which will certainly have unintended

consequences for many years to come.

You can see the market reaction most clearly in

Argentina's credit default swaps, which gapped out to a whopping 1,325bp. That's up 350bp on

the day, and it's a clear sign that the markets are extremely worried the

unexpected ruling will cause the very thing it's ostensibly trying to cure: an

Argentine default.

This isn't the end of the story - but it is the

beginning of the end. Argentina is making noises about appeals, but at this point it's not

obvious that higher courts will even accept the case. And while it's true that

the Second Circuit did end up punting on the one bit of the original ruling

which actually had teeth, all of their language implies that they'll ultimately

uphold it.

Here's the problem facing the US courts.

Everybody agrees - even Argentina is happy to agree to this - that Argentina

owes Elliott Associates lots of money. Everybody agrees that Argentina has a

contractual obligation, under New York law, to pay lots of money, to Elliott,

right now if not sooner. But of course Argentina has made no such payment. And

so it's very easy for Elliott to go to a New York judge (in this case, Thomas

Griesa), and get that judge to hand down a judgment telling Argentina in no

uncertain terms that it owes Elliott lots of money. And Argentina will in turn

treat that judgment with exactly the same respect it gives to the original bond

contract. In fact, for tactical reasons, Elliott has chosen not to become a

judgment creditor: if it just had a court judgment, and not a bond contract,

then it would find it much harder to argue arcane legal points about various

bits of legal boilerplate in the contract.

Which is why, in February, Griesa came up with

an order which carried much more force than a simple judgment. The order comes

with a real punch:

Within three (3)

days of the issuance of this ORDER, the Republic shall provide copies of this

ORDER to all parties involved, directly or indirectly, in advising upon,

preparing, processing, or facilitating any payment on the Exchange Bonds (collectively,

"Agents and Participants"), with a copy to counsel for NML. Such

Agents and Participants shall be bound by the terms of this ORDER as provided

by Rule 65(d)(2) and prohibited from aiding and abetting any violation of this

ORDER, including any further violation by the Republic of its obligations under

Paragraph 1(c) of the FAA, such as any effort to make payments under the terms

of the Exchange Bonds without also concurrently or in advance making a Ratable

Payment to NML.

This is very cunning stuff. Remember that

Argentina is happily current on its outstanding bonds: what that means in

practice is that every time a coupon payment is due, it pays that money to the

bondholders' Trustee, Bank of New York (BK), which in turn divvies it up between all the

current bondholders. As you might guess from its name, Bank of New York is very

much under the jurisdiction of New York courts. And Griesa, with this order, is

taking aim directly at Bank of New York. If Argentina tries to pay its existing

bondholders without at the same time paying Elliott Associates and the other

holdouts, then Bank of New York will be aiding and abetting a violation of his

order. And there's no way it wants to do that.

The problem here, from a legal perspective, is

that once Bank of New York has the money, the money belongs to bondholders, not

to Argentina. And so it's difficult for Griesa to tell the bank it's not

allowed to remit the money to the bondholders who have every legal right to it.

In terms of the meat of Griesa's order, it's

this part about "aiding and abetting" which really gave Elliott hope

that it might finally be able to collect on what it was owed. And, just to drag

things out a bit longer, that's the one bit of the order that the Second

Circuit felt uncomfortable about:

We do have concerns about the Injunctions' application to banks acting as

pure intermediaries in the process of sending money from Argentina to the

holders of the Exchange Bonds. Under Article 4-A of the U.C.C., intermediary

banks, which have no obligations to any party with whom they do not deal

directly, are not subject to injunctions relating to payment orders…

Oral

argument and, to an extent, the briefs revealed some confusion as to how the

challenged order will apply to third parties generally. Consequently, we

believe the district court should more precisely determine the third parties to

which the Injunctions will apply before we can decide whether the Injunctions'

application to them is reasonable.

This gives a sliver of hope to Argentina - but

only a sliver. The Second Circuit remanded the case back down to Griesa to

clarify his order a bit, and they're really only asking for clarification

rather than evisceration. The whole point of the order is that it includes US

actors as well as Argentina itself, and there's no way that Griesa will reword

things so that Bank of New York is suddenly magically excluded.

Once Griesa's clarification makes its way back

to the Second Circuit, the judges there have made it abundantly clear that

they're well-disposed towards the lower-court judge, and very ill disposed

towards Argentina. As JP Morgan's Vladimir Werning says of the request for clarification:

"While this may generate a perception that the Appeals Court can change

its mind if the District Court clarifications do not satisfy it, we doubt this

is likely to happen."

I'm sure that Argentina and its lawyers have

been working for a while on contingency plans which they could put in place

were the Second Circuit to uphold the lower court's decision: those plans have

now taken on extra urgency, but it's really not obvious what Argentina can do,

especially if it wants to avoid yet another event of default. There's paying

off the holdouts, of course, but that would be politically incredibly

dangerous, and it's hard to imagine Cristina Kirchner ever signing off on such

a thing. She might not be the world's most principled politician, but her

hatred for Elliott and the holdouts is real. And as Werning's excellent note

says, none of the alternatives are particularly appealing - or particularly

likely to avoid the countries CDSs being triggered.

Argentina does have time - a fair amount of

time, too, if this ends up being successfully appealed to the Supreme Court.

After all, the US government argued on Argentina's side; I'm no lawyer, but

I've got to imagine that SCOTUS tends to at least hear the cases which would

otherwise go against the government's wishes.

What's more, the Second Circuit has given the

Supreme Court an interesting third option: rather than completely upholding the

original order, or striking down completely, the Supremes could basically go

just as far as the Second Circuit did today, and then ultimately reject the

extra step of including Bank of New York and/or other blameless intermediaries.

I don't think that will happen, however: in many

ways it would represent the worst of both worlds. It would still be a huge

change to international law, and would amount to a very significant weakening

of the Foreign Sovereign Immunities Act . The US government, in other words,

would suffer a massive loss. And at the same time it would in practice let

Argentina off the hook - and no one has much sympathy for Argentina here, a

country which has been thumbing its nose at the US courts for years.

So the base-case scenario at this point has to

be that Elliott will ultimately win. I can hardly believe I'm writing these

words: I've been writing about holdouts, or vultures, or whatever you want to

call them, for a good dozen years now, and although they've had victories here

and there, there's been nothing remotely as big or precedent-setting as this.

When push comes to shove, governments make laws, and the official sector is

generally good at closing ranks and making sure that sovereign rights and

immunities are protected.

Except, that doesn't seem to be the case any

more. The part of the Second Circuit's argument dealing with sovereign immunity

is probably the weakest bit, but the court certainly doesn't pay much if any

deference to the United States and its arguments here:

The Injunctions

at issue here are not barred by § 1609. They do not attach, arrest, or execute

upon any property. They direct Argentina to comply with its contractual

obligations not to alter the rank of its payment obligations. They affect

Argentina's property only incidentally to the extent that the order prohibits

Argentina from transferring money to some bondholders and not others. The

Injunctions can be complied with without the court's ever exercising dominion

over sovereign property. For example, Argentina can pay all amounts owed to its

exchange bondholders provided it does the same for its defaulted bondholders.

Or it can decide to make partial payments to its exchange bondholders as long

as it pays a proportionate amount to holders of the defaulted bonds. Neither of

these options would violate the Injunctions. The Injunctions do not require

Argentina to pay any bondholder any amount of money; nor do they limit the

other uses to which Argentina may put its fiscal reserves. In other words, the

Injunctions do not transfer any dominion or control over sovereign property to

the court. Accordingly, the district court's Injunctions do not violate § 1609.

A lot of the oral arguments surrounded this point, and it seemed, to

me at least, that Argentina's side was much more convincing. It's true that

"the Injunctions do not require Argentina to pay any bondholder any amount

of money," but if Argentina wants to stay current on its bonds - and

that's a perfectly reasonable thing to want to do - then they absolutely do

require Argentina to pay holdout creditors at the same time. Which seems like

an override of Argentina's sovereign will to me. Conversely, if Argentina

chooses not to pay the holdouts, it will be in the odd position that it can do

anything it wants with its money - it is a sovereign nation, after all - except

give it to the very creditors it made a solemn promise to pay in 2005 and 2010.

The result is a very weird and scary world, for

all sovereigns, including the US - and for the markets, too. Sometimes, markets

are secretly cheering the vultures: after all, the more money vultures make,

the healthier the bid for bonds when countries tumble towards default. But in

this case, the decision is clearly bad for markets. For one thing, by emboldening

holdouts, it makes future sovereign debt restructurings much more difficult.

(The Second Circuit tries to say that it doesn't, thanks to something called

Collective Action Clauses, but as Anna Gelpern says, that argument doesn't hold water.)

More broadly, this ruling is just one more step

towards a world where the old verities about sovereign risk simply don't hold

any more. It used to be that sovereigns were sovereign: that was bad news if

they unilaterally decided to default on you, but other than that it was pretty

good news. Now, however, they're at the mercy not only of unelected technocrats

at places like the IMF or the ECB; they're also at the mercy of unelected

judges in New York. Sovereigns have less freedom of movement now than they have

done in a very long time, and we're only beginning to grok the implications of

those constraints.

As far as Argentina is concerned, it might just

have to pay the holdouts. No one knows how much money that might entail spending:

the figures range from $1.3 billion at the low end (large, but manageable) to

$12 billion at the high end. That would cause real economic damage. Again,

Werning is good on this. And whether or not Argentina pays the holdouts, the

risk of a credit event in the CDS market are seriously high right now: there's

a hundred ways that things could go wrong and the CDS could get triggered. In

fact, this being Argentina, it's entirely possible that the government could

deliberately trigger the CDS, after various important people had loaded up on

protection.

The upshot is a significant rise in uncertainty,

in an asset class which could really do without such a thing right now. The

Second Circuit's narrow and constructivist view of some long-ignored legal

boilerplate could end up having very profound effects on global markets and

economics. Maybe that's what the letter of the law demanded. But I sure wish it

didn't.

Argy Clear um pari passu Urteil zu umgehen ?

3. Argentina can try to re-route the payments on restructured debt: To avoid making payments in US jurisdiction Argentina might consider offering performing debt holders payment of coupons into a new offshore trust.

Legally, this is complicated to the extent that one of the orders of the judge requires Argentina not to modify its payment mechanisms for Exchange Securities. Evidently Argentina, in exercise of sovereignty, may attempt to do so anyway. Yet financial institions under NY law that facilitate such a scheme might be liable to being labeled in contempt of court and therefore Argentina would rely on other institutions to help it carry out such a plan.

But in addition, a successful execution would require solving some operational unknowns. We have heard opinions from legal experts that payment to the Trust in NY is "hard-wired" into bond contracts. If so, to re-route payments offshore (outside US) Argentina may need to carry out an exchange with current restructured debt holders. Yet an offshore payment would sacrifice US legislation and—while it is clear investors have an incentive to facilitate the payment of their coupons—it is not clear if they would rush to embrace a different legislation. Argentina can argue that a full payment in USD in Argentina should be viewed as superior to risk of payments being pro-rata in NY. But following all the noise around risk of "pesofication" we doubt all investors dependant on the BoNY trust structure have the appetite to make the gamble. A foreign non-US jurisdiction (UK?) might offer a (temporary?) shelter to continue payments but 100% participation in a swap of this kind has slim chances.

Legally, this is complicated to the extent that one of the orders of the judge requires Argentina not to modify its payment mechanisms for Exchange Securities. Evidently Argentina, in exercise of sovereignty, may attempt to do so anyway. Yet financial institions under NY law that facilitate such a scheme might be liable to being labeled in contempt of court and therefore Argentina would rely on other institutions to help it carry out such a plan.

But in addition, a successful execution would require solving some operational unknowns. We have heard opinions from legal experts that payment to the Trust in NY is "hard-wired" into bond contracts. If so, to re-route payments offshore (outside US) Argentina may need to carry out an exchange with current restructured debt holders. Yet an offshore payment would sacrifice US legislation and—while it is clear investors have an incentive to facilitate the payment of their coupons—it is not clear if they would rush to embrace a different legislation. Argentina can argue that a full payment in USD in Argentina should be viewed as superior to risk of payments being pro-rata in NY. But following all the noise around risk of "pesofication" we doubt all investors dependant on the BoNY trust structure have the appetite to make the gamble. A foreign non-US jurisdiction (UK?) might offer a (temporary?) shelter to continue payments but 100% participation in a swap of this kind has slim chances.

Konsequenzen für den Bondmarkt und die Holdouts nach dem pari passu Urteil des Court of Appeals // Werning JPMorgan

Konsequenzen für den Bondmarkt und die Holdouts nach dem pari passu Urteil des Court of Appeals // Werning JPMorgan

Argentina: Holdout creditors' "trick or treat" threat warrants cutting Argentina debt to MW in model portfolio

Holdout creditors score win in long awaited US Appeals Court "pari passu" ruling

Argentina likely to exhaust alternatives before considering compromise

Argentina's performing bond market can suffer further from "friendly", as well as "enemy fire"

Cut Argentina debt to marketweight in model portfolio

Hold out creditors litigating against Argentina in US courts have brought forward Halloween holiday this year. The "trick or treat" was issued via a US Appeals Court ruling which resonated negatively in bond markets. The problem for the market is that Argentina is being told to "treat" but performing debt bondholders are the potential victims of a (very nasty) "trick" if Argentina does not concede hand outs.

In this note we complete the thoughts that formed our immediate impressions in response the news of the adverse ruling for Argentina ("Argentina: Court rules pari passu—quick & dirty and negative"). In a nutshell, as we think about the details and possible scenarios our concerns over the risk this litigation poses to Argentine performing bond holders remains large.

This ruling is the key headline risk event that the market has been waiting for but the result is not what the market was expecting. Thus, it is negative for the soverign debt. Whether the risks are worth more than the $7.0-9.5 price gap in long-duration performing bonds that already transpired is the key question investors face.

We believe the market worries are unlikely to resolved for better or for worse in the near term and hence market anxiety may escalate. Given the legal complexities of the case and the fact that a politically-charged decision now lies unpredicatbly in Argentina's lap, we prefer to stay sidelined at this stage and recommend cutting Argentina exposure to marketweight (see last section below).

The ruling is very harsh, raising risks of an adverse "end game" for performing debt

With regards to the ruling there are many things to highlight. We abstract from an analyzing arguments driving the decision in depth (sufficient is to say that the Appeals Court literally trashed a laundry list of Argentina's arguments—with one caveat). The main take aways are the following:

1. The ruling AFFIRMS the judgements of the district court against based on breach of "pari passu" (i.e. issuing an opinion on the "broad" definition that serves establish precedents for sovereigns in general, not just the "narrow" definition based on argument of the "lock law" specific to Argentina).

For practical purposes, this boils down to disallowing Argentina to pay holders of restructured bonds in US territory unless it pays holdout creditors in the lawsuit (with claims worth $1.33 bn)—despite the payments are in a bondholder trust which technically means they are no longer property of Argentina. Specifically, this involves 2005 and 2010 Exchange Securities which we interpret to mean Discount, Pars, GDP Coupons and Global 17s under foreign law, which includes USD-denominated NY law and EUR denominated UK law securities; in contrast, bonds from those same exchanges but under Argentine law, irrespective of whether they are USD or ARS, are not affected as they are paid outside US jurisdiction).

2. The case is REMANDED to District Court so that two issues are clarified :(i.e. the "pro rata" formula and the injunction's application to third parties and intermediary banks) and then will be returned to Appeals court for FURTHER CONSIDERATION.

While this may generate a perception that the Appeals Court can change its mind if the District Court clarifications do not satisfy it, we doubt this is likely to happen. The pro-rata formula (while critical for all parties and potentially controversial) once defined is a technicality and it is unlikely to be scrutinized by the Appeals Court. We suspect that the clarification regarding financial intermediaries can be resolved if a definition is narrowed in a way that institutions are unaffected when they (a) are in the chain of payment for Exchange Securities that do not directly recieve proceeds from Argentina or in trust for bondholders (but caught somewhere between) or (b) involved in transactions unrelated to Exchange Securities being targeted (for example, a payment of a different bond)

3. The ruling does not mention the stays on the injunctions that the District Court concended to Argentina for the purpose of allowing it to proceed with its appeal.

The lack of reference to the 'stays' raises a valid concern that if a solution is not adopted quickly by parties involved, the District Court injunctions and the Appeals Court affirmation would already apply to upcoming coupons on Exchange Securities due in December of 2012 (Discounts and GDP warrants). The worry is that without stays a potentially defensive and hasty political response from Argentina might surface, irrespective of the collateral damage to the bond markets it may entail. However, we believe that—with the remend requested and with Argentina sure to seek a "certioari" of the US Supreme Court—it is more likely that the threatening remedies will not be enforced until the judiciary process is complete (which, given court timing, inclines us to think that December 2012 coupons will be paid as usual). In fact, Argentina's Secretary of Finance Cosentino addressed this issue in a public statement, ratifying that the "stays" are in place currently.

Next steps: The ball is Argentina's (better said, Cristina's) court

The end game in this litigation will depend on Argentina's response. Below are some thoughts on the path ahead and a lot of concerns over the political capacity of the government to find a solution that limits collateral damage to the bond market:

1. Argentina can choose abide by the Courts and settle with hold out creditors the claims. Litigation claims ($1.33 billion) can be settled without affecting Argentina's broader payment capacity (and hence the risk premium on Argentina performing bonds). Argentina can dip into its $45 billion of reserves to make the payment as it currently does for performing debt service.

However, there are economic and a political factors at play that make this unlikely: On the economic side, we note that there are a total of $6.6 billion untendered debt (litigating and non-litigating), mostly foreign law, that could "piggy back" on this ruling to demand similar compensation. And considering that Argentina's definition of claims is limited to principal (but plaintiffs could demand PDI since 2001) the liability can conceivably inflate to an figure in the neighborhood of $11-12 billion. So it is not clear that a "small" $1.3 billion payment (or some lower amount settled privately between plaintiffs and Argentina) closes the door on the issue.

Political considerations are more worrisome. In our view the alternative of settling claims with litigating investors looks like a difficult pill to swallow politically for a government that has publicly blasted the "vulture funds" as public enemy No. 1 (but not exclusively so) of the Argentine people. We give a slim chance to this unless plaintiffs accept a similar deal similar to the restructuring exchange (which allows the government an elegant exit: selling the deal publicly as one that respects the terms of its own original proposal). Yet, should plaintiffs be expected to accept such a proposal after years of litigation? We are doubtful... but we (and bond markets) would be relieved to be proven wrong.

What could trigger an surprise compromise by Argentina? Maybe, the silver lining in the YPF nationalization is that now the government has a need for the state-run oil company to raise funds that help it fulfill the investment goals the President cares about. And maybe, the government acknowledges that it must resolve litigation uncertainty in a cooperative manner to make yields attractive for YPF and make its strategy to solve the energy imbalance feasible again. But too many "maybes"—and a leap of faith that the government will readily adopt economic cost-benefit analysis over political calculation—are involved in this vision for comfort.

2. Argentina is sure to appeal (or seek "certiaori"): Argentina's public statements (from Secretary of Finance Cosentino) in response to emphasized that the latter "is not the end of litigation" making it clear that the next step is to seek a judiciary review of the ruling. What is not clear is if Argentina will appeal immediately or wait for Judge Griesa to resolve on the clarifications required by the Appeals Court.

We understand that an Appeal can be made by Argentina to an expanded Appeals Court before the sovereign would need to seek a "certiaori" from the US Supreme Court. This again suggests that performing bond coupons are not immediately threatened. The clock on the threat to coupon payments on restructured debt starts ticking once the Supreme Court rejects the case or if it accepts it and subsequently affirms the injunctions. The Supreme Court might take 3-6 months to decide to take Argentina's appeal or reject it. So an appeal buys time and reduces the risk of a defensive and hasty response by Argentina that inflicts collateral damage.

A Supreme Court ruling could eventually overturn the Appeals Court. At the end of day, Argentina has already proven capable of doing so in other litigation also involving holdout creditors. Moreover, recall the US government did submit an Amicus Brief siding with Argentina on the (broad) interpretation of "pari passu" that might be taken into account (although the Appeals Court evidently brushed its relevance aside). Assessing those chances, however, is the subject of a different conversation that involves analyzing in detail the arguments supporting the ruling.

3. Argentina can try to re-route the payments on restructured debt: To avoid making payments in US jurisdiction Argentina might consider offering performing debt holders payment of coupons into a new offshore trust.

Legally, this is complicated to the extent that one of the orders of the judge requires Argentina not to modify its payment mechanisms for Exchange Securities. Evidently Argentina, in exercise of sovereignty, may attempt to do so anyway. Yet financial institions under NY law that facilitate such a scheme might be liable to being labeled in contempt of court and therefore Argentina would rely on other institutions to help it carry out such a plan.

But in addition, a successful execution would require solving some operational unknowns. We have heard opinions from legal experts that payment to the Trust in NY is "hard-wired" into bond contracts. If so, to re-route payments offshore (outside US) Argentina may need to carry out an exchange with current restructured debt holders. Yet an offshore payment would sacrifice US legislation and—while it is clear investors have an incentive to facilitate the payment of their coupons—it is not clear if they would rush to embrace a different legislation. Argentina can argue that a full payment in USD in Argentina should be viewed as superior to risk of payments being pro-rata in NY. But following all the noise around risk of "pesofication" we doubt all investors dependant on the BoNY trust structure have the appetite to make the gamble. A foreign non-US jurisdiction (UK?) might offer a (temporary?) shelter to continue payments but 100% participation in a swap of this kind has slim chances.

4. Argentina can unilaterally decide to set aside future coupon payments in an (offshore) trust as a display of willingness and capacity to pay, risking accusations of default. If Argentina does not want to play the cards it has been dealt within the established rules it may consider rewriting these rules in a convenient way. It might be deemed a political "face saver" to announce that it will deposit funds for Exchange Securities in a separate offshore trust that respects restructured bond holders claims but defies litigating creditors claims and US court orders to pay them pro-rata.

This option would lead to further collateral damage in bond markets. If the coupons do not reach their original destiny and the latter is truely "hard-wired" into bond contracts (as has been suggested to us) this option would likely qualify as a default. Of course, technically a formal default triggering CDS would have to be defined by market participants responsible for that process. Argentina's situation, if it chooses to stay current on restructured bonds but paying into a different trust, would at a minimum raise controversial opinions in this process. Moreover, for a CDS trade to look attractive bonds must trade at distressed prices that make them cheap to deliver and it is not clear they will if Argentina actually continues to pay the corresponding cashflows on the bonds.

Final thoughts: Any safe havens?

Unfortunately, Argentina's poor communication with markets does not provide assurance that the sovereign will (or even can) signal its strategy clearly and in a pre-emptive fashion that might help to reduce market anxiety rapidly. Thus, "pari passu" litigation will remain an overhang for the bond market.

All bonds—irrespective of currency—that are under local law and paid through mechanisms not within the jurisdiction of the NY court are spared from the "pari passu" litigation consequences. In the near term, the local law USD bonds like Bodens and Bonars have suffered though less than foreign law bonds due to shorter duration and due to investor understanding that they can continue to be paid by Argentina without third party interference.

Argentina: Cutting overweight back to marketweight in our EMBIG Model Portfolio

We moved overweight Argentina in our EMBIG Model Portfolio on 17th September as a supportive environment post the Fed’s announcement of QE3 provided support for high spread Emerging Maket sovereign performance and we saw a cyclical lift to the domestic economy in 2013, with ‘no news’ for a period in Argentina being good news for bond prices. Today’s 'news' from the pari passu court ruling is a negative risk we highlighted at the time and we see a period of uncertainty ahead. We entered the overweight when Argentina (global) 8.75% $ 2017s were at a price of 100.00, which was a spread to treasuries of 801bp versus the EMBIG spread then at 282bp. We take losses on this overweight and move back to marketweight given the downside risks, with current prices of Argentina (global) 8.75% $ 2017s down at 91.00/95.00 (spread to USTs of 1,053bp / 935bp as at 1.30pm US time 26th Oct).

We rebalance other positions in our EMBIG Model Portfolio to keep the overall portfolio position unchanged. Many questions remain about the next steps in this process, which is unusual in that there is potential risk to bond holder payments that is not being driven by the unwillingness or inability of the issuing government (Argentina) directly. The reaction of the government to this ruling and the next legal stages are not yet known and may turn out to delay or avoid any impacts on bond payments. This keeps from wanting to move underweight at this stage, until we have more clarity on these next steps and given the price drop already. However, we think that any bounces in bond prices will likely be sold into as investors are left with a great deal of uncertainty on the future payment process and where CDS are likely to be a price point that widens as technical triggers are focused on.

Vladimir Werning (AC)

(1-212) 834-4144

vladimir.werning@jpmorgan.com

J.P. Morgan Securities LLC

Jonny Goulden

(44-20) 7134-4470

jonathan.m.goulden@jpmorgan.com

J.P. Morgan Securities plc

www.morganmarkets.com

https://mm.jpmorgan.com/EmailPubServlet?h=jjungnd5&doc=GPS-973118-0.html

Known Unknowns in Pari Passu ... and More to Come posted by Anna Gelpern

Known Unknowns in Pari Passu ... and More to Come

posted by Anna Gelpern

The Friday decision in NML et al. v. Argentina has clearly shaken the sovereign universe. While I am normally more prone to panic than Felix Salmon or Vladimir Werning, these wise folks reasonably point out that the decision may spell the End of the World for sovereign immunity, sovereign debt as we know it, etc. "May" is the operative word in my view. We need more information and analysis (stay tuned) before we dash for the bunker.

Yes, it looks like previously unenforceable sovereign debt has suddenly become more enforceable. Zero to something. But how much? It depends on too many things to know for sure. Will the Second Circuit rehear the case en banc? Will the U.S. Government and those who sat on the sidelines in this round -- the IMF, the Federal Reserve, more intermediary banks -- pipe in? Will SCOTUS take the case? Will Judge Griesa pare back the effect of the injunction if Elliott wins the appeals? Vladimir is right that this will not go away. But we really do not know enough about what "this" is to say much more than that. We have a Second Circuit opinion that seems to disdain its own implications, and some history of SCOTUS slapping down Argentina when the U.S. Government was on the other side. Go figure. Ask your favorite court maven (I will).

Yes, Argentina's CDS have gone through the roof, correctly reflecting immense uncertainty about the near future of its foreign bond stock. But I doubt that either the courts or the policy establishment would find this fact compelling. Argentina has been a headache for too many for too long to elicit sympathy. What I really want to know -- consistent with the thrust of the U.S. brief -- is whether other sovereign and sovereign CDS spreads are going nuts, and if yes, which ones. The way Argentina wins here is by invoking the good of the system without overclaiming. No mean feat.

Yes, we seem to have a damagingly broad interpretation of pari passu out of the Second Circuit. Does it mean that a prospectus warning holdouts they might not get paid amounts to a subordination in violation of the pari passu clause, at least versions similar to Argentina's? Maybe. Will foreign courts adopt the Second Circuit's reading, exposing countries such as Italy to Argentina-scale uncertainty? Yikes. For what it's worth, this is where I feel most comfortable being worried. I will be looking for more data on just how many other countries have vulnerable formulations of the clause.

All this to say, there is a big difference between "mostly dead" and "all dead". And I suspect that Argentina -- and more so the broader universe of sovereign debt and sovereign immunity -- is "mostly dead" as far as pari passu goes. For now.

Argentina Lost! Elliott Won! Pari Passu Rules! (... or Why I Love Being a Law Professor ...)

Argentina Lost! Elliott Won! Pari Passu Rules! (... or Why I Love Being a Law Professor ...)

posted by Anna Gelpern

The pointy-head caucus can exhale -- the Second Circuit ruled on the pari passu drama, and it did not go as I had expected. Not only did the court rule against Argentina, but it did so on relatively broad grounds, giving a fair amount of meaning to a massively indeterminate bit of Latin, and ignoring the practical challenges of enforcing the ruling. The judges upheld the injunction directing Argentina to pay holdout creditors who refused to participate in its 2005 and 2010 debt exchanges whenever it services the new bonds that came out of the exchange. Ironically, the opinion acknowledged that it was impossible to figure out what proportionate payment would mean under the circumstances, but chucked the question back at the lower court. The judges also remanded the question of how exactly one might enforce this injunction without attaching sovereign property abroad or dragging in third parties (New York banks moving Argentina's money), despite the fact that the holdouts admitted in court that their next step would be to go after the banks on aiding and abetting theories. But these are all questions for another day. Between this ruling and the Ghana boat mess, October 2012 will go down as a heady month for Elliott and its kind.

Here are my main take-aways so far:

- The court did not anchor its interpretation of the pari passu clause in Argentina's Lock Law, which bars the government from paying the holdouts, though the law got plenty of play. This was both risky and smart. It was risky because the court's reasoning might be construed to suggest that securities disclosure telling prospective holdouts that they would not be paid was tantamount to payment subordination. It was smart because a decision based solely on the Lock Law could be made moot by its repeal. I bet the "Risk Factors" sections of sovereign prospectuses are getting a close read just now.

- The court adopted wholesale Elliott's reading of Argentina's two-part pari passuclause -- "[t]he Securities will constitute . . . direct, unconditional, unsecured and unsubordinated obligations of the Republic and shall at all times rank pari passu without any preference among themselves. The payment obligations of the Republic under the Securities shall at all times rank at least equally with all its other present and future unsecured and unsubordinated External Indebtedness ..." (court's emphasis) -- effectively to punish Argentina for payment discrimination, whether or not it had subordinated the securities themselves. This is a big deal for two reasons.

- First, violating the pari passu clause just got much easier, though I am not sure how far we can take the implications. Would missing a payment to one creditor while paying another amount to a distinct violation, and give the aggrieved creditor specific performance? This will depend on the precise wording of the clause, but the range of possibilities is considerably wider.

- Second, contract drafters have a great new reason to let go the boilerplate schtick. Of course no one will start drafting each word from scratch. But this panel's textualist reading, interpretation technique straight out of Contracts textbooks, and its skepticism of Argentina's evidence on market custom, should jolt the contract production process. Not all bad.

- The U.S. government got no love whatsoever. This could be because of the United States' awkward position of avoiding the Lock Law (still the right thing to have done, in my view), its pale oral argument, or because the opinion seemed determined to bracket its enforcement and policy implications. The goal was to bolster contracts and punish very bad debtors. So what if there is no way of enforcing the injunction without grabbing offshore property or New York banks--we are just telling Argentina what to do. So what if Greece has holdouts--its contracts are not under New York law. So what if the reading seems to cover international organizations -- creditors say they are not after them.

- The opinion mentions Collective Action Clauses twice as both important, and a meaningful bar to future pari passu litigation. This is completely, totally, unambiguously wrong for all the reasons I have given before, and I cannot believe the judges did it when they did not have to. On the bright side, it gives me and my buddies more to write about.

- This may not be as radical as it seems. Everyone would acknowledge that Argentina is an extreme case of vocal intransigence, even by defaulting sovereign standards. In another extreme case last summer, an English judge put an outer boundary on the use of exit consents in distressed debt exchanges. While initial reporting (mine included) suggested that this might seriously damage an established restructuring technique, later analysis suggested more of a modulation. I have said in the past that whatever pari passu means, Argentina is the closest I have seen to breach. Well, now a court says it too, if a bit more strongly than I would. Is it open season on sovereigns via pari passu, consequences be darned? I doubt it.

- It is not over by a long shot. Apart from all the decisions that still have to be taken by the lower court on remand (which could end up gutting the injunction), Argentina will surely appeal. It will ask the full circuit to hear the case, and if it loses again, it will try to go to the Supreme Court. Much excitement to come, with lots of law to be made.

If I were Argentina, an agent bank, or much of the sovereign establishment, I would be shocked and dismayed. If I were Elliott, I would be dancing the jig. As it stands, I am looking forward to some really interesting law and policy developments to come.

October 26, 2012 at 11:53 AM in Sovereign Debt

Comments

Abonnieren

Kommentare (Atom)

1) If by some act intermediary banks are in fact forced to follow the injunction, forcing Argentina to make a pro-rata payment to holdouts in order to continue servicing their performing debt, doesn't this mean that it constitutes an event of default on the currently performing debt? If memory serves me correctly, the exchange bond prospectus says that Argentina is not allowed to give holdouts a better offer than what it initially offered everybody. Does this matter at all to the courts?

2. What would the timing look like for an injunction to be enforced, assuming that the Second District affirms whatever Griesa comes back with? This case has dragged on for a while but I wonder if we might see an unravelling within the next year or so.